Why we invested in Rivan Industries

by Taavet HinrikusThe need to decarbonise our economy, alongside our ever-growing demand for energy, is one of the biggest problems facing humanity today. We will electrify a large part of the economy, but for other parts we will still need conventional fuels. However, to get to net zero, these fuels need to be decarbonised alternatives.

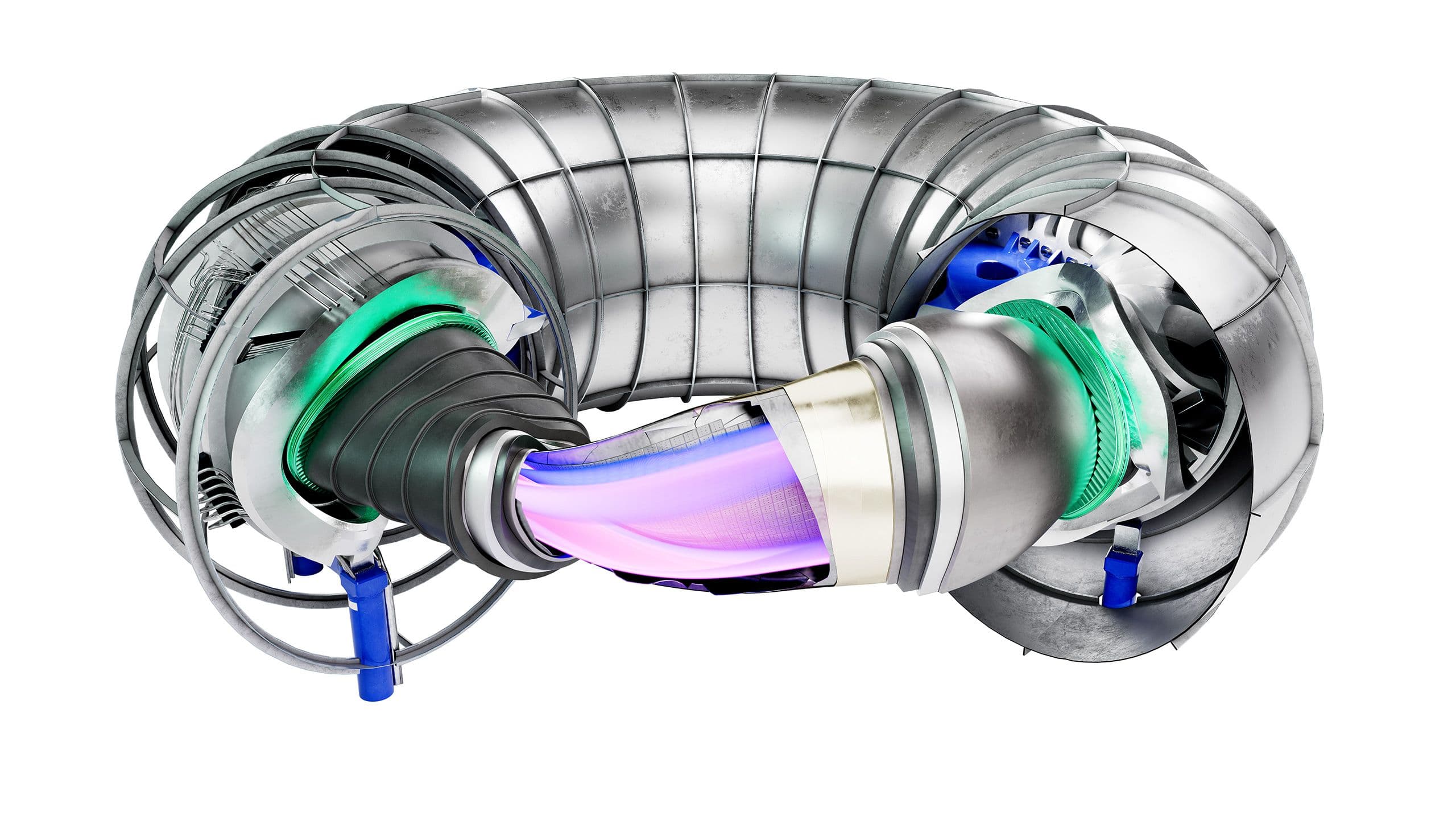

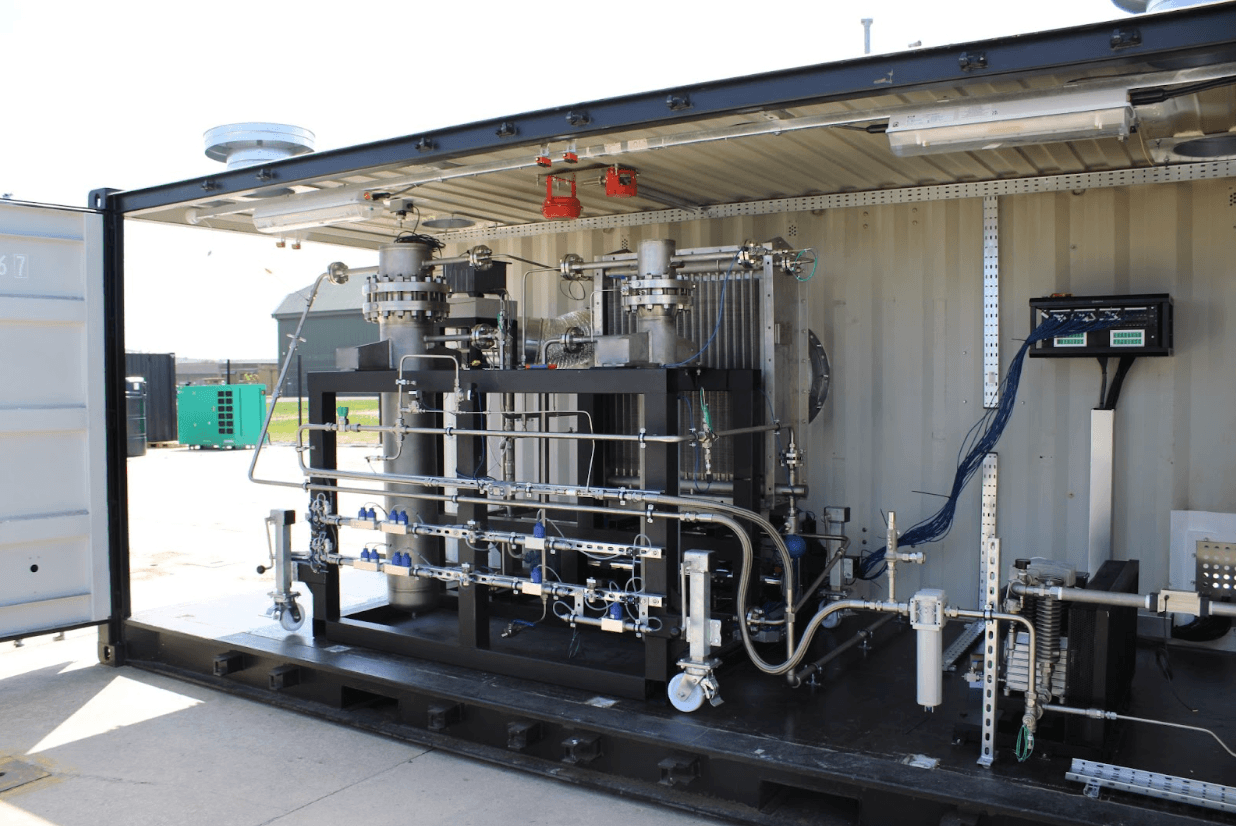

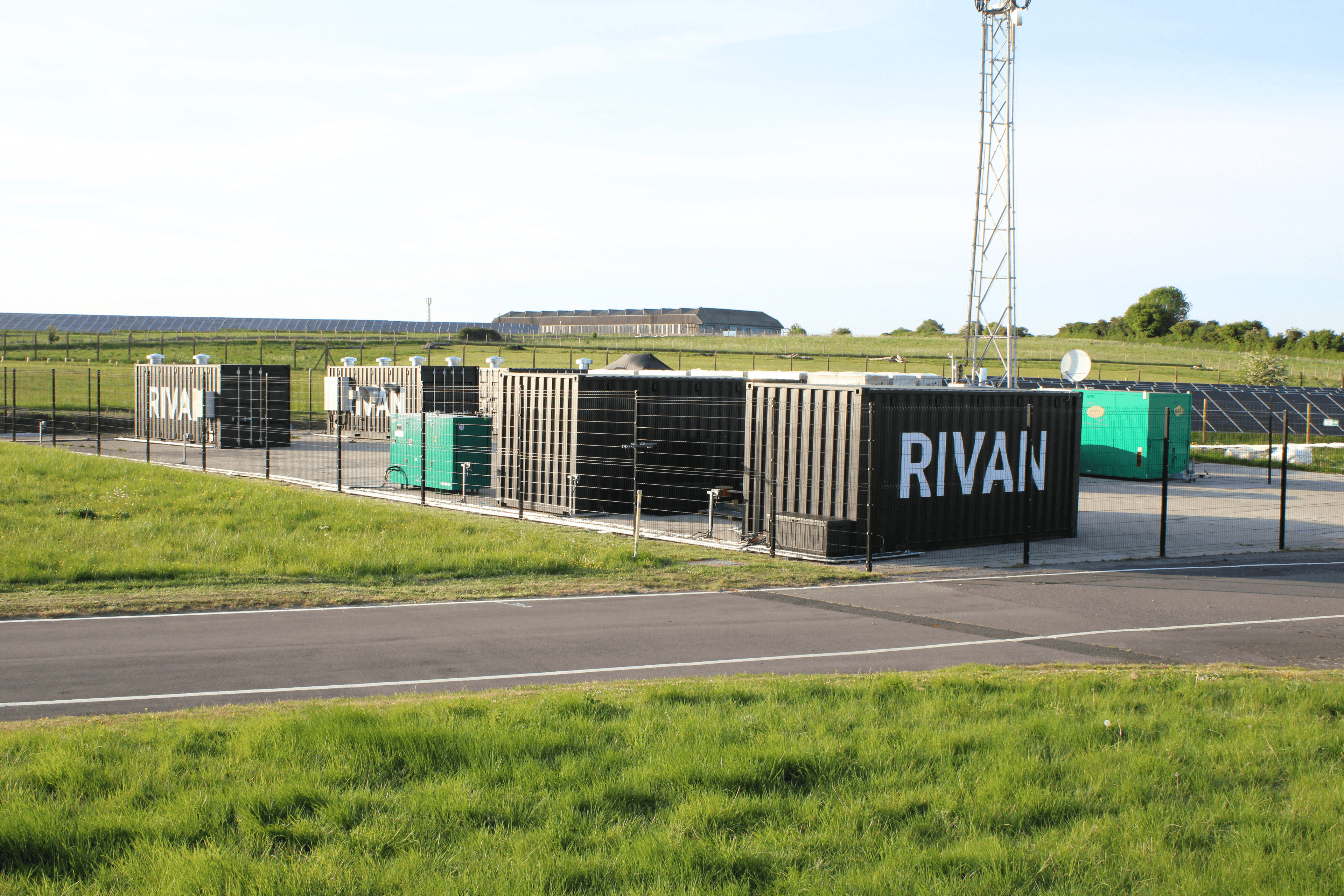

Rivan, a London-based startup, is building low-cost, vertically integrated synthetic natural gas (SNG) production plants that combine three core technologies: a direct air capture (DAC) system that uses the naturally occurring calcium cycle to absorb CO2 from the air, an electrolyser that splits water to release hydrogen, and a “sabatier” reactor that converts those molecules into methane. By taking CO2 out of the atmosphere, and using off-grid solar power, the startup’s SNG is fully carbon neutral.

A new approach

The traditional engineering zeitgeist for DAC systems and electrolysers has been to maximise energy efficiency, due to the high cost of power needed to operate these systems. However, this has resulted in high CAPEX machines that often struggle to pay back the initial investment.

Rivan takes a different approach. Using cheap and commonly available components, they have created inefficient, yet highly scalable systems.

Why now

Rivan’s planned inefficiency is economically justified by the rapidly falling price of the solar energy that is used to power their systems. The global average price of electricity generated by photovoltaic (PV) panels has plummeted from around $0.37 per Kwh in 2010 to around $0.05 per Kwh in 2020, and is predicted to reach around $0.01 per Kwh in the next decade.

The core drivers for this are abundance and low-cost input materials, along with modular and simple designs. This has turned solar panels into a commodity whose cost - decreasing exponentially with increasing production quantities - is shaped by open and competitive markets. By designing with a focus on cost reduction, iteration speed and manufacturing scalability, Rivan are deploying the same forces to produce the cheapest SNG on Earth.

As Rivan forces down the cost of SNG production, European demand for decarbonised synthetic alternatives is skyrocketing, a result of new demands for energy security and EU/ UK regulations. These include, to name a few, the Renewable Energy Directive that has set quotas for increasing use of alternative, greener gas sources in transportation by 2030, while the Emissions Trading Scheme incentivises adoption through the carbon price that makes it more expensive for businesses to emit CO2.

Regulations like these are accelerating the growth of the e-fuels market, which is predicted to increase in size from $8.75bn in 2024 to $87.92bn by 2032.

The Team

Rivan Industries is led by founder Harvey Hodd, a former professional football player who’s now on his third startup.

Harvey wasn’t your typical footballer — on his way to games on the match bus, his teammates would tease him for reading physics and chemistry books. This self-taught method of learning science and engineering concepts has helped him to tackle the problem of producing synthetic gas from first principles, and find an approach that others haven’t tried.

Harvey also boasts the kinds of qualities that you find in many elite sportspeople who have spent years of their life trying to compete and become really, really good at something, giving him an appreciation for the discipline and the hard grind that it takes to succeed.

And Harvey has shown his ability to transfer a winning sporting mentality to the world of business, having founded and successfully sold two ecommerce startups before launching Rivan. This is a pattern that you often see with ambitious founders — they start off building a fairly simple company, sell that, and then take the lessons, scar tissue and capital they’ve gained to go on to start something that solves a hard problem that they really care about.

Hard problems

By taking advantage of cheap solar energy, Rivan Industries has done what many others have struggled to do: find an economical way to take carbon out of our atmosphere, creating a product that is more valuable than the sum of its parts.

In the short-term, the company will meet the growing demand for carbon-neutral SNG, injecting directly into the gas grid, selling to offtakers across Europe and reducing our collective reliance on imported energy. In the long-term, the company will produce more complex synthetic liquid fuels to power large cargo ships or planes, helping to decarbonise some of our most polluting industries.

At Plural we love to invest in high-quality, repeat founders (they represent around half our portfolio) who are taking what they’ve learnt and applying it to hard problems. Harvey is doing just that with Rivan, using a counter-intuitive but logical and scalable approach to addressing humanity’s urgent need for cleaner power sources, creating a new source of sovereign European energy in the process.