Why we invested in Isometric

by Khaled HeliouiA couple of months after selling Bigpoint, I attended an investor / founder dinner in London. I was sitting in front of a VC who quickly started sharing (unsolicited) insights, probably collected from board memories or the most recent podcast, to founders on how to run a recruiting process and set a great culture internally. All of it was clearly nonsense which I would have ignored if not for the neighbouring founders who may have had to pay a hefty price if taken seriously so I started debunking piece by piece why this didn’t make any sense to the investor’s dismay (suffice to say, I wasn’t invited again). Instead I offered some practical takes based on lived experiences, and many, many failures. While there is no monopoly on good judgement, it stands clear non-operational investors have a very high market share in terms of harmful advice.

A founder next to me kept on asking follow-up questions in increasing detail regarding HR policies and how to best identify and retain great talent. This was the first time I met Eamon. He was still in the early stages of building his startup with c. $2m in ARR, but his operational potential felt way ahead of that already. I ended up backing him, Ruhul and Husayn to support their work at Onfido and went on to advise them as they scaled growing past $100m in ARR in a few years, becoming the leader in online identity verification and background checking.

Eamon had obvious potential then and I saw how he, Husayn and Ruhul could build a world-class software company. And yet, for all the potential and intuition a talented first-time founder can have, there are a number of critical dynamics for a category-defining startup one can only grasp through experience:

- Have exposure to what “great” means in the critical fields of company building (HR, technology, product, sales, growth, operations)

- Learn how to hire an excellent team and build a culture of high operational cadence where world class people are subservient to the mission

- Prioritise governance and carefully avoid or learn to contain challenging and misaligned investors who will without fail buckle at the most important juncture

- Learn how to navigate life and death challenges for your company without compromising your principles or your vision

The margin of error and the level of responsibility one takes differs depending on the mission you are tackling and the industry you’re serving. As many have learnt you can’t “move fast and break things” when people’s health or a country’s security are at stake. It has been less written about in Europe (with the obvious U.S. examples of Elon & PayPal before Tesla & SpaceX or Palmer with Oculus before Anduril) but founders are more likely to tackle (really) hard problems the second time around.

I have the utmost conviction that one of the most powerful agents of change for society is when battle-hardened founders take on critical missions and leverage their scar tissue and wisdom to fix parts of the economy that are broken. We already have impressive examples in Europe such as Torsten who is now building Helsing, leveraging AI to protect democracies, after building NaturalMotion or Özlem & Uğur who set on to found BioNTech, coming up with scientific breakthroughs and executing on fast-paced industrialisation to contain a pandemic, after building two pharmaceutical companies.

As with the founders above, the Eamon we’re dealing with today is of a totally different calibre than when he first set out to build a company. He’s shed most of his naivety and has the wisdom of a scarred founder who has faced many life and death situations, through many failures paid the price to learn the meaning of excellence, how to navigate challenging economic cycles and manage your cash accordingly, how to muster your team around a vision and convince people to stick around while there is no rational reason to, without sacrificing your vision.

The kind of calibre necessary to take on one of the most important, if not the most important, challenges of our time. How to tackle the looming climate disaster.

Without trust, scale is hopeless

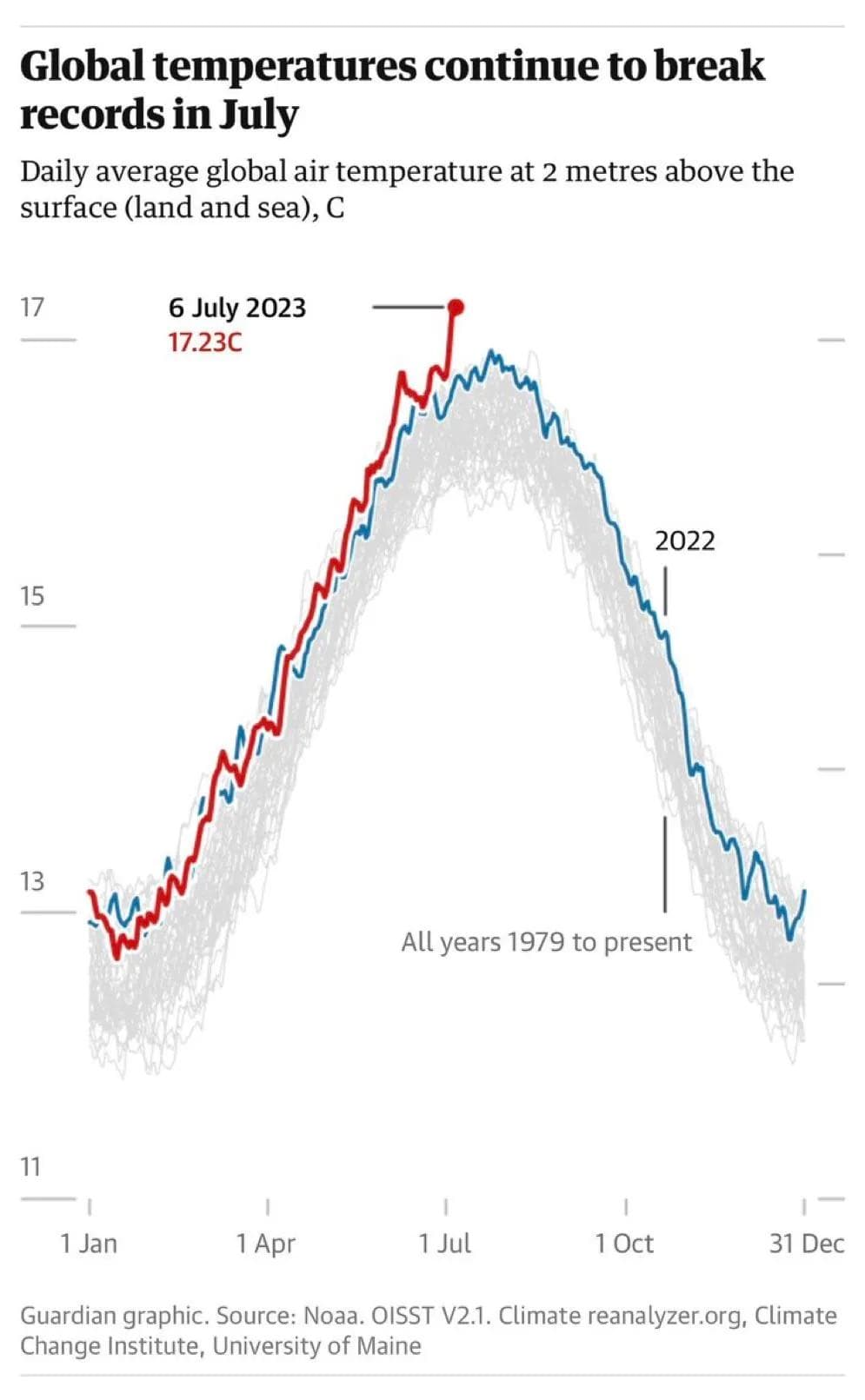

One of the advantages of building a climate company in Europe, and not the US, is that you have to spend less time convincing people of the reality of the climate disaster we are facing. Unless you are burying your head in the sand, it doesn’t require having a PhD to acknowledge the man made climate disaster we are already experiencing. Between the escalation of climate-led disasters, the sad-yet-predictable new records in temperature reached every year, the resulting migrations of populations struggling to feed themselves or get access to water due to rampant shortages, it has now become non-negotiable to only reduce emissions. We are way too late to only do that. We must also aggressively scale methods that can durably and verifiably remove carbon dioxide from the atmosphere.

It is commonly believed that the main hurdle preventing the scaling of carbon dioxide removal is the price of carbon removal (ranging anywhere between $500 and $1,500 per tonne). Significant budgets will readily become available should prices reach the coveted $100 per tonne and hopefully take us from the few kilotonnes of carbon durably removed per year currently to the 3.8 gigatonnes the industry needs to reach — one of the clearest examples of a potential $1 trillion+ industry to be created over the next decade.

We can already see the deflationary effect of technology amongst leading suppliers, resulting in large investors starting to meaningfully invest in the space, yet opacity persists for buyers in regards to the level of verifiability of the different scientific pathways, the scientific rigour upheld by the diversity of suppliers available as well as the soundness of their industrial processes. If there is one pitfall the carbon removal industry cannot replicate it surely is the debacle of the “phantom credits” of the offsetting industry. The quantity of capital to be invested in the industry doesn’t only require affordable removal but also robust, independent, reliable monitoring and verifiability especially in an industry that with no doubt will see the flocking of numerous actors and where the failures of a few can undermine the credibility of all.

Isometric aims to build and maintain the infrastructure that is missing today for the durable scaling of the carbon removal industry by building the first registry that will provide buyers with quantification of durability and certainty of removal as well as surfacing reliable credits for verified and delivered tonnes. Reflecting Eamon’s focus on governance and appreciation of misalignment risks, Isometric charges buyers, and not suppliers, for developing protocols, verifying removals and eventually issuing credits. An inordinate amount of time and effort has been invested in building a governance that would allow the removal industry to avoid some of the problems encountered in the offsetting industry.

Considering the urgency of the disaster we are facing, there is not only an obligation of alignment but also of aggressive scaling. As Eamon himself acknowledges, building a company for the second time feels like starting with a cheat code in terms of team building and he is already surrounded by one of the most impressive teams in the industry including some of the best performers from the most impressive tech companies in Europe (still struck by the pace of execution Ola & Ellie brought from the outset). For driven people aiming to tackle the looming climate disaster, I can’t think of a better platform to join.

One of the main challenges the team will face will be to manage the tension between the aspiration of utmost scientific rigour while aiming for the aggressive scaling and rapid execution to meet the urgency of our crisis. The kind of tension founders usually grapple with when scaling a product from a nascent market to a whole industry, requiring them to take distance and manage the diversity of actors and interests (buyers, suppliers, scientists, regulators) and guarantee the reliability of industrialisation that is required for the durable removal at scale of carbon dioxide. The kind of tension that leads to category defining companies. I recall Garrett criticising the Uber app after the company’s IPO explaining how it would be so more elegant and usable had he still been running the company before then looking up to me and concluding “but Uber would only be in 10 cities”.

I cannot think of anyone better equipped than Eamon and the Isometric team to take on this challenge. I am proud that Plural is co-leading Isometric’s seed round with LowerCarbon and committing to support the team in their mission to build the first independent, transparent registry for durable carbon dioxide removal.